how long does the irs have to collect back payroll taxes

However there are a few things to consider. If you are due a refund for withholding or estimated taxes you must file your return to claim it within 3 years of the return due date.

Irs Payroll Tax Rjs Law Payroll Tax Attorney San Diego California

After this 10-year period or statute of limitations has expired the IRS can no longer try and collect on an IRS balance due.

. Understanding collection actions 4 Collection actions in detail5. Under IRC 6502a1 once the IRS has assessed the tax it has 10. Ad File Settle Back Taxes.

Subject to some important exceptions once the ten years are up the IRS has to stop its collection efforts. The IRS has a set collection period of 10 years. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you.

However there are several things to note about this 10-year rule. You can only claim refunds for returns filed within three years of the due date of the return. Up to 25 cash back As a general rule there is a ten year statute of limitations on IRS collections.

Sometimes when the IRS places your account in currently not collectible status they will mark a follow-up date for review of your account. You Wont Get Old Refunds. The IRS doesnt pay out old refunds.

Investigation and Consequences The IRS considers unpaid payroll taxes a very serious violation. The IRS 10 year window to collect starts when the IRS originally determines that you owe taxes that is usually when you filed your tax return or when the result of an IRS audit. This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date they were assessed.

10 years from the date of. This can happen in a number of ways. Used to secure information7 IRS Actions Affecting Passports7.

Determining the Statute of Limitations on Collections. This time restriction is most commonly known as the statute of limitations. The IRS has a set collection period of 10 years.

Everything before that is lost and you cannot collect that return. How Long Does the IRS Have to Collect Taxes. That collection period is normally 10 years.

Possibly Settle Taxes up to 95 Less. Put simply the statute of limitations on federal tax debt is 10 years from the date of tax assessment. Get Your Qualification Options for Free.

If you file early lets say January 31 2020 the IRS has until April 15 2030 to collect. Back in 2005 the California legislature enacted for the first time in history a 20-year collection statute of limitations for taxes owing to. Though the chances of getting live assistance are slim the IRS says you should only call the agency directly if its been 21 days or more.

The 10-year deadline for collecting outstanding debt is measured from the day a tax liability has been finalized. This strategy will not work for Maryland taxes as there is no statute of limitations in place and your state taxes will never expire. Trusted A BBB Member.

This means that the IRS can attempt to collect your unpaid taxes for up to ten years from the date they were assessed. If you are unable to pay at this time 3 How long we have to collect taxes 3 How to appeal an IRS decision4. Federal Tax Lien5 Notice of Federal Tax Lien5 Levy.

Ad Owe back tax 10K-200K. For most cases the IRS has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due. Some of these taxes are almost 20 years old.

After the IRS determines that additional taxes are due the. This is a long time when you consider that the IRS only has 10 years to collect its tax debts. In general the IRS has 10 years after the date of assessment to collect on delinquent taxes and tax-related fees although there are a few exceptions.

Once taxes are assessed whether on your tax return or by the IRS in a notice theres a different time limit on IRS collections. Time Limits on the IRS Collection Process. This is the length of time it has to pursue any tax payments that have not been made.

A seizure of property6 Summons. Take Advantage of Fresh Start Program. The same rule applies to a right to claim tax credits such as the Earned Income Credit.

Call the IRS or a tax professional can use a dedicated hotline to confirm that you only have to go back six years back for unfiled taxes. The IRS usually marks a case for future review only if there is an indicator when. If you can make it past those 10 years you may never have to pay back your taxes.

As a general rule there is a ten year statute of limitations on IRS collections. The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

Subject to some important exceptions once the ten years are up the IRS has to stop its collection efforts. This 10-year limit is known as the collection statute expiration date CSED and it frees tens of thousands of Americans from their tax liabilities every year. If this occurs in most situations the IRS will give you two years as uncollectible until the follow-up date kicks in.

First and foremost the statute is carefully crafted to read. There is an IRS statute of limitations on collecting taxes. Owe IRS 10K-110K Back Taxes Check Eligibility.

The IRS takes failure to pay payroll taxes especially with respect to active businesses very seriously and often assigns field agents to stop businesses that accrue payroll tax liability over more than two quarters. When it comes to tax debt the IRS generally has up to 10 years from the date your taxes were assessed to collect from you. Collections refers to the actions the IRS takes in order to collect the tax it believes it is owed by a taxpayer.

Under Federal law there is a time restriction on how long the IRS has to collect unpaid taxes. If you dont pay on time. This means the IRS should forgive tax debt after 10 years.

See if you Qualify for IRS Fresh Start Request Online.

Irs Payroll Business Debt Tax Attorney Helping You Settle Or Lower Your Back Taxes Stop The Irs Protect Your Bank Wages Today

Tax Consolidation Irs Debt Relief Help From Licensed Professionals

Irs Tax Letters Explained Landmark Tax Group

Faqs On Tax Returns And The Coronavirus

Irs One Time Forgiveness Program Everything You Need To Know

How Do I Get My Irs Tax Debt Forgiven Fortress Tax Relief

Winchester Va Irs Tax Problems Help Kilmer Associates Cpa P C

Irs Sets Guidelines Based Off Trump S New Payroll Tax

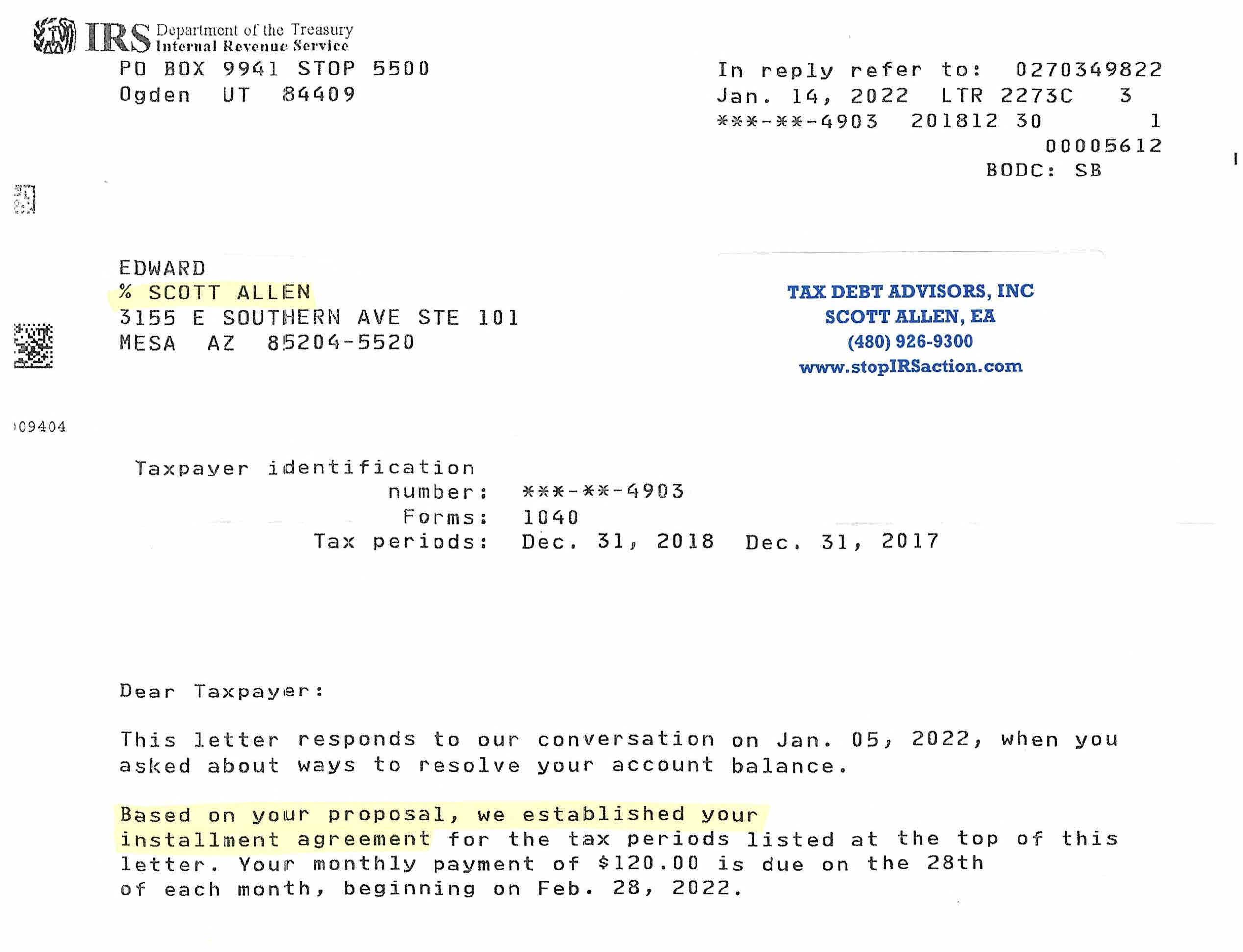

Irs Tax Payment Plan Tax Debt Advisors

Owe The Irs You Have A Few Options If You Cannot Afford The Bill Forbes Advisor

What Does The Irs Do And How Can It Be Improved Tax Policy Center

Santa Clara California Irs Tax Problems Help Nri Tax Group

Can The Irs Collect After 10 Years Fortress Tax Relief

How Long Can The Irs Try To Collect A Debt

When Does An Irs Tax Lien Expire Rjs Law Tax And Estate Planning

What To Do If You Receive A Irs Tax Lien Notice What Are Your Options Irs Fresh Start Program Helpline 1 877 788 2937 Tax Relief Blog May 3 2016

Are There Statute Of Limitations For Irs Collections Brotman Law

A Brief Guide On How To Stop An Irs Levy Irs Irs Taxes Tax Debt