parker county texas tax appraisal office

Read frequently asked questions about boat registration. The office also.

Parker County Appraisal District 1108 Santa Fe Dr Weatherford Texas Us Zaubee

Agricultural and special appraisal.

. Yes you can and can only go back 2 years. The Comptrollers office does not have access to your local property appraisal or tax information. 2022 The Parker County Texas Sheriffs Office said paramedics tried to save the childs life but he or she died at a hospital.

Over the past decade SDS has built a customer-focused team an integrated technology platform and a reputation for rock solid delivery. ASCII characters only characters found on a standard US keyboard. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

Quickly search property records from 2044 official databases. The median property tax in Denton County Texas is 3822 per year for a home worth the median value of 178300. Collin County Clerks Office Collin County Administration Building 2300 Bloomdale Rd Suite 2106 McKinney TX 75071.

Contact TPWD Boat Section 800 262-8755 BoatRegtpwdtexasgov. Remember you may still have time to protest your property tax value. 6 to 30 characters long.

Find locations for boat registration and titles. This meeting is conducted with a staff appraiser at the appraisal district office. Parker County Property Records are real estate documents that contain information related to real property in Parker County Texas.

Journey through the Legal Avenues. Death Records include information from Texas and Federal death registries and indexes including the National Death Index. Collin County has one of the highest median property taxes in the United States and is ranked 48th of the 3143 counties in order of median property taxes.

Harris County has one of the highest median property taxes in the United States and is ranked 152nd of the 3143 counties in order of median property taxes. Denton County has one of the highest median property taxes in the United States and is ranked 77th of the 3143 counties in order of median property taxes. Please call our office to speak with a customer support representative.

News email and search are just the beginning. The median property tax in Collin County Texas is 4351 per year for a home worth the median value of 199000. Many Texas county tax offices and appraisal districts have chosen SDS to be their technology partner.

Posted Posting. Harris County collects on average 231 of a propertys assessed fair market value as property tax. To increase performance the application is currently displaying the top 1000 results for each query.

Appraisal Review Board ARB hearings. El Paso County has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in order of median property taxes. Analyze both market value and unequal appraisal when preparing for your Texas property tax appeal.

Search El Paso County TX property records by Owner Name Account Number or Street Address. Most questions about property appraisal or property tax should be addressed to your countys appraisal district or tax assessor-collector. As an agent for the Texas Department of Motor Vehicles the Tax Assessor-Collectors office provides vehicle registration and title transaction services for the residents of the county.

Sign up for free email service with ATT Yahoo Mail. The Historical Document application was designed by the Harris County District Clerks Office to display historical legal documents accumulated by the county dating back to 1837. The median property tax in Harris County Texas is 3040 per year for a home worth the median value of 131700.

For mail requests all checks should be made payable to the Collin County Clerk. Must contain at least 4 different symbols. Our goal is to provide the most innovative and efficient solutions in the Texas local government arena.

10272022 Due Time. Informal Hearing After filing a protest you will be notified of a date and time to attend a hearing. Go to Data Online.

Quickly search marriage records from 878 official databases. In situations where the county appraisal districts collect tax for flood control etc homeowners are allowed 3000 as an exemption on the county taxes. Collin County collects on average 219 of a propertys assessed fair market value as property tax.

Our property tax consulting services are available in more than 200 Texas appraisal districts including Bexar Brazoria Collin Dallas Denton Fort Bend Galveston Harris Montgomery Tarrant Travis and Williamson. Looking for FREE marriage records certificates in Texas. Mail ownership transfer transaction requests to your nearest TPWD Law Enforcement Office.

Rv slide out motor wiring diagram a b Aug 26 2022 WC board approves budget tax rate. Texas Death Records provide information relating to a persons death in Texas. Please contact our property tax experts at 877 482-9288 or 713 290-9700 to confirm your online signup is in order.

Pro members in El Paso County TX can access Advanced Search criteria and the Interactive GIS Map. Looking for FREE property records deeds tax assessments in Texas. 601310000079139 Due Date.

The Weatherford College Board of. March 11 2022 at 1158 pm. It typically lasts.

Discover more every day. See list of boat forms. Texas Vital Records Offices County Clerks and the Texas Health Department maintain Death Records.

The residents of Parker County usually visit the Tax Assessor-Collectors office more frequently than any other branch of county government. Denton County collects on average 214 of a propertys assessed fair market value as property tax. 300 PM AgencyTexas SmartBuy Member Number.

I am also disable and live on fixed incomei live in Sabine countyEast Texas. Find Texas Death Records including. The Clerk bills all searches at 10 while copies of a property record cost 1 per page and an additional 5 per certified document if requested.

All members can search El Paso County TX appraisal data and print property reports that may include gis maps land sketches and improvement sketches. The median property tax in El Paso County Texas is 2126 per year for a home worth the median value of 101800. If you are not sure please complete the enrollment form.

Appraisal districts can answer questions about. Public Property Records provide information on homes land or commercial properties including titles mortgages property. El Paso County collects on average 209 of a propertys assessed fair market value as property tax.

Parker County Appraisal District

Jenny Gentry Parker County Tax Assessor Collector Facebook

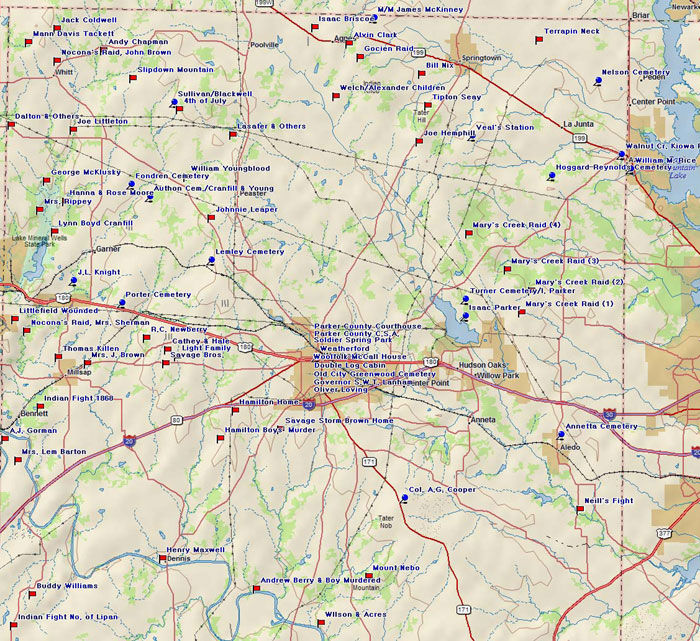

Parker County Texas Genealogy Familysearch

As Texas Central S High Speed Rail Development Stalls Cy Fair Residents Question Project S Future Community Impact

![]()

Appraisal District Contact Information

Data Download Tarrant Appraisal District

Parker County Appraisal District

Parker County Texas Genealogy Familysearch

Parker County Courthouse Weatherford Thc Texas Gov Texas Historical Commission

Tpwd Agriculture Property Tax Conversion For Wildlife Management

Armstrong Appraisal District Property Tax Page

![]()

Appraisal District Contact Information

Parker County Appraisal District

Parker County Property Tax Protest Parker County Land Tax Protest Facebook

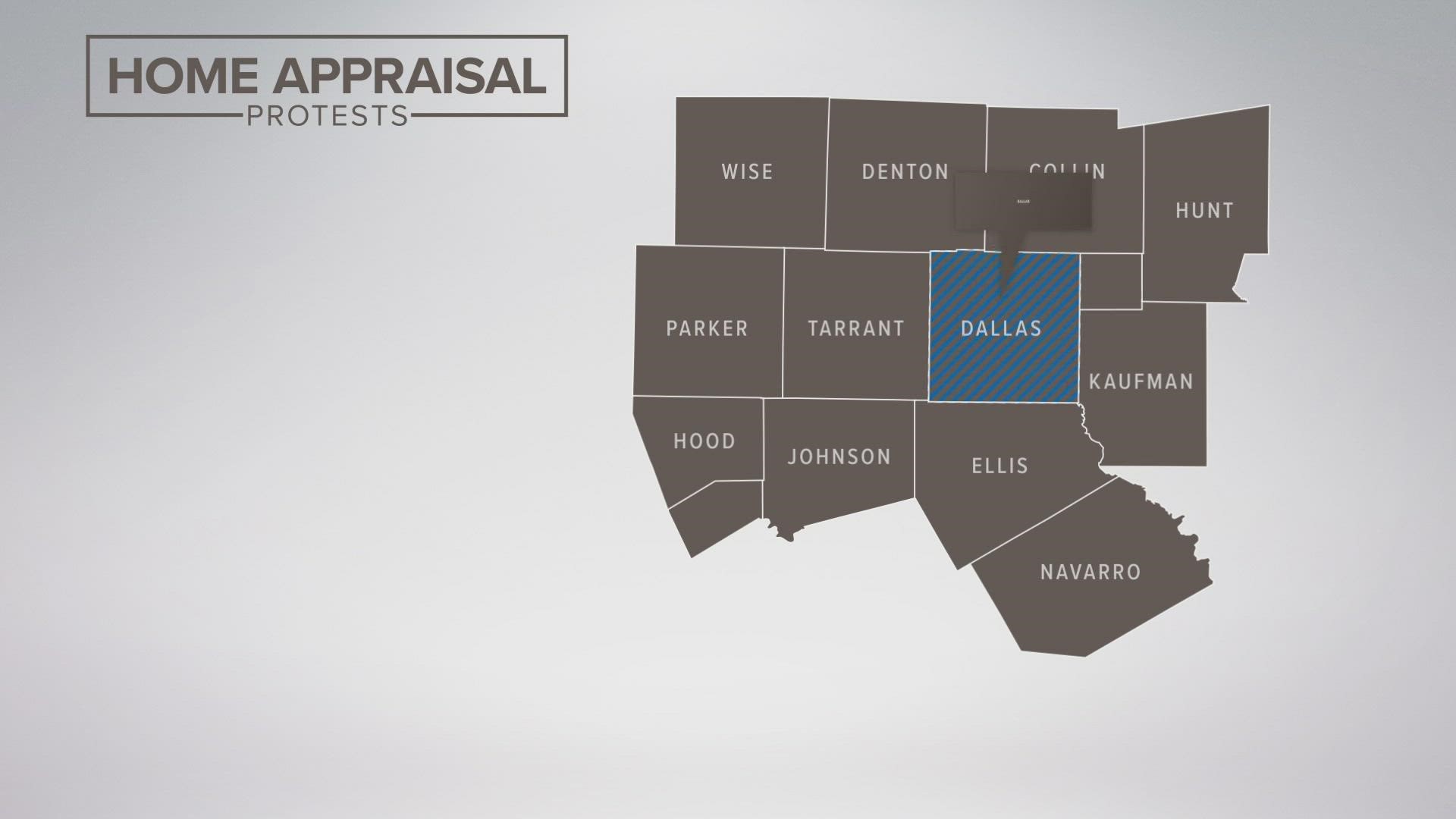

Dfw Property Taxes More Than 200k Protests Filed So Far Wfaa Com