how are annuities taxed to beneficiaries

Ad Learn More about How Annuities Work from Fidelity. Considering the Beneficiary of Your Annuity.

Twitter Universal Life Insurance Life Insurance Quotes Life Insurance Policy

Ad Learn some startling facts about this often complex investment product.

. Taxes and Annuity Payouts. Just like any other qualified account such as a 401k or an individual. Usually a 401k or another tax-deferred.

If you inherit an annuity youll have to pay income tax on the difference between the principal paid into the annuity and the value of the annuity when the owner dies. If you want to understand how an inherited annuity is taxed two terms that are critical to grasp are qualified annuities and non-qualified annuities. Qualified annuity distributions are fully taxable.

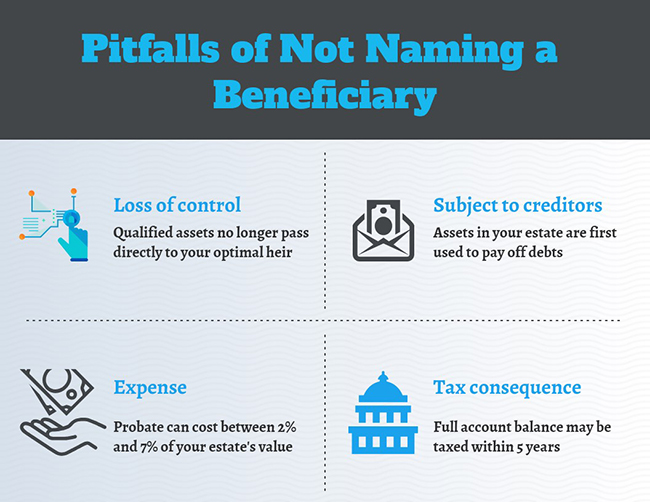

Your beneficiaries have a few options for dealing with the inherited annuity -- and the tax bill it triggers. But this is not the case when inheriting an. Get Personalized Rates from Our Database of Over 40 A Rated Annuity Providers.

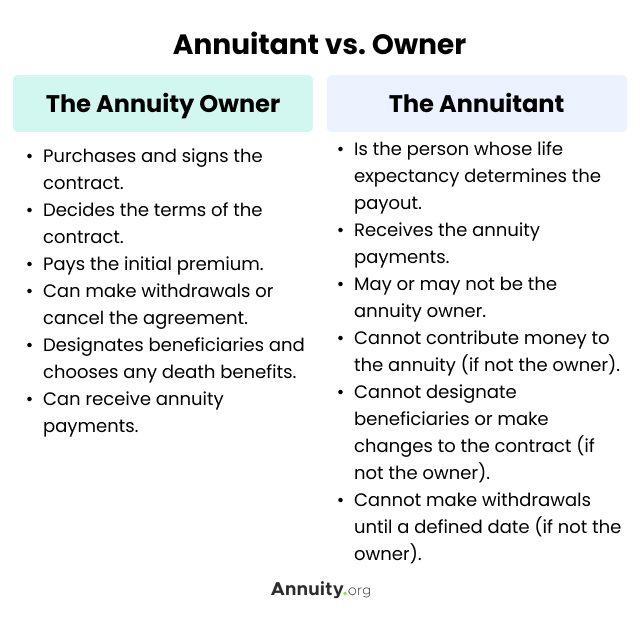

As a result consideration of whether to use a trust as the beneficiary of an annuity must weigh the adverse tax consequences against the favorabledesired non-tax provisions of the trust. The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is. Ad Learn some startling facts about this often complex investment product.

These payments are not tax-free however. One you might not have heard of is called an annuity stretch It gives non-spouse beneficiaries a way to receive income and defer taxes. Designating Others When you specify someone else as your beneficiary such as a child or spouse the money will pass by contract.

When you inherit an annuity the tax rules are similar to everything described above. An annuity that has been funded with previously untaxed funds is considered a qualified annuity. Based on whether you purchased the annuity with qualified pre-tax or nonqualified post-tax.

When an individual inherits a life insurance policys death benefit they typically will not have to pay any income taxes. Whether or not an inherited annuity is subject to inheritance or estate tax the beneficiary is liable for income tax. The variable annuity contract may provide that at your death a person you name as a beneficiary will receive a lump-sum death benefit.

You will only pay income taxes on the earnings if its a non-qualified annuity. Ad Learn More about How Annuities Work from Fidelity. Until you receive your annuity distributions or stream of income taxes are deferred.

For example if the owner. In particular most annuities have a death benefit and understanding how that death benefit will get taxed to the beneficiary who receives it is an important part of deciding. You will pay taxes on the full withdrawal amount for qualified annuities.

Qualified annuity taxation. The simplest option is to take the entire amount as a lump sum. Ad Americas 1 Independently Rated Source for Annuities.

Income from annuities is taxed as ordinary income. Your relationship to the beneficiary matters when it comes to annuity payments and taxation so. Taxes at Death.

If the payout is over an annuitants lifetime and the annuitant outlives life expectancy all further payments. An annuity is qualified if. When an annuity payment is made 50 of each payment would be income taxable.

Depending on.

Abney Associates Ameriprise Financial Advisor In Melville Ny Ameriprise Financial Financial News Financial

Inherited Annuity Tax Guide For Beneficiaries

Indexed Annuity Returns Rates And Examples Annuity Health Insurance Policies Index

Trust Vs Restricted Payout As Annuity Beneficiary

How Do Beneficiary Designations Affect Your Retirement Planning

Annuity Beneficiaries Inherited Annuities Death

Annuity Beneficiaries Inheriting An Annuity After Death

Annuity Beneficiaries Inheriting An Annuity After Death

Annuitant What It Is And How It S Different From The Annuity Owner

Trust Vs Restricted Payout As Annuity Beneficiary

Abney Associates Ameriprise Financial Advisor In Melville Ny Ameriprise Financial Financial News Financial

Annuity Beneficiaries Inheriting An Annuity At Death 2022

Annuity Beneficiaries Inheriting An Annuity After Death

Living Abroad What About My South African Family Trust Family Trust South African South

Annuity Beneficiaries Inheriting An Annuity At Death 2022

Beneficiaries Pay No Taxes On Non Registered Annuities Annuity Quotes Annuity Life Insurance Quotes

Period Certain Annuity What It Is Benefits And Drawbacks

Difference Between Annuitant And Beneficiary Difference Between

4 Types Of Insurance You Need To Protect Your Business Universal Life Insurance Life Insurance Quotes Life Insurance Policy